Complete Guide to Using Your Owner-Occupied Equity to Purchase an Investment Property

Using the equity in your home to buy an investment property is one of the most common strategies Australians use to grow wealth — especially once their first property has increased in value.

If you already own a home, even one purchased with a low deposit or a government scheme, you may be surprised at how quickly equity can be used to fund your next purchase.

This guide explains:

-

What owner-occupied equity is

-

How the process works step by step

-

Required documents and timeframes

-

Loan structure options (principal & interest vs interest-only)

-

Why separating owner-occupied and investment debt is critical

-

A real-world example using the First Home Guarantee Scheme

What Is Owner-Occupied Equity?

Owner-occupied equity is the difference between:

-

Your home’s current market value

-

The remaining balance on your home loan

Example:

If your home is worth $800,000 and your loan balance is $560,000, your equity is $240,000.

Most lenders allow you to access equity up to 80% of the property value, sometimes higher depending on your situation and lender policy.

This equity can be used toward:

-

The deposit on an investment property

-

Stamp duty and purchase costs

-

Structuring loans more efficiently

Step-by-Step: How Using Equity Works

1. Equity Assessment & Valuation

Your mortgage broker arranges a valuation on your owner-occupied home to confirm its current value and usable equity.

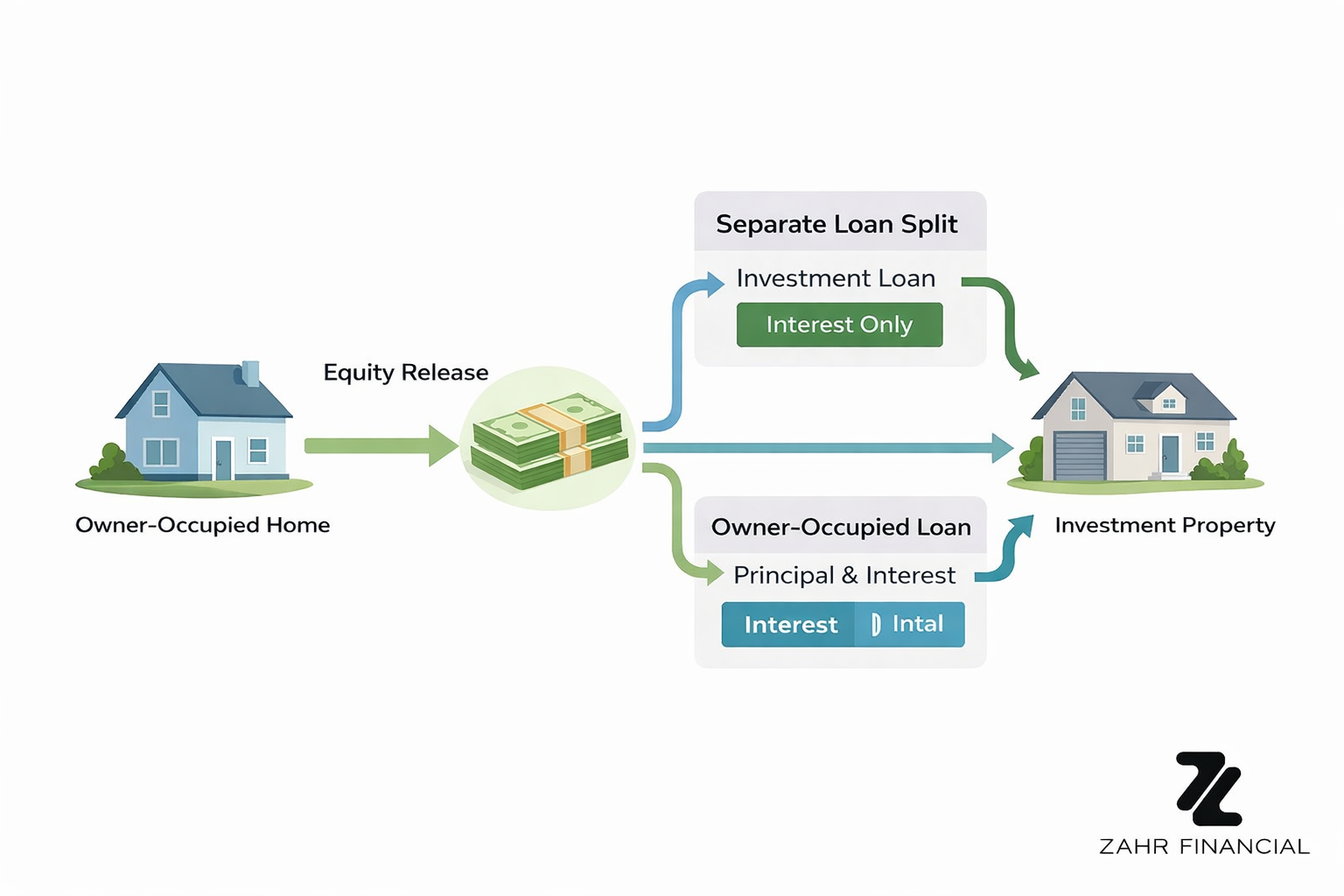

2. Loan Structure Setup

A separate loan split (or new loan) is created against your home specifically for investment purposes.

This is crucial — and we’ll explain why later.

3. Pre-Approval for the Investment Property

Once equity is confirmed, you receive a pre-approval showing:

-

Purchase price range

-

Deposit funds available

-

Estimated repayments

This puts you in a strong position when making offers.

4. Purchase & Settlement

After a property is secured, the lender completes:

-

Valuation on the investment property

-

Final servicing checks

-

Formal approval and settlement

Real Example: Using Equity After the First Home Guarantee Scheme

One of my clients, Hassan, purchased his first home using the Government First Home Guarantee Scheme, allowing him to buy with a small deposit and no LMI.

A few years later:

-

His property value had increased

-

His loan balance had reduced

-

He had built usable equity, despite starting with a low deposit

We:

-

Accessed equity from his owner-occupied home

-

Structured it as a separate investment loan split

-

Used the funds for the deposit and costs on an investment property

Importantly, using the First Home Guarantee Scheme did not prevent Hassan from investing later. With the right structure, his equity worked just like any other homeowner’s.

This is a common misconception — government schemes help you get in sooner, they don’t stop future investing.

Documents You’ll Need

To use equity for an investment property, lenders typically require:

Personal & Identification

-

Driver’s licence or passport

Income Evidence

-

2–3 recent payslips

-

Latest ATO Notice of Assessment

-

If self-employed: financials, tax returns, BAS

Owner-Occupied Property

-

Current home loan statement

-

Rates notice

-

Valuation (organised by your broker)

Investment Property (once found)

-

Contract of sale

-

Rental appraisal

-

Strata details (if applicable)

Your broker coordinates this to minimise delays.

Timeframes You Can Expect

| Stage | Estimated Time |

|---|---|

| Equity valuation | 3–7 business days |

| Pre-approval | 1–3 business days |

| Formal approval | 3–7 business days |

| Settlement | 4–8 weeks |

Timeframes vary by lender and complexity, but planning early helps avoid pressure.

Loan Structure Options Explained

Owner-Occupied Loan

-

Usually Principal & Interest

-

Focused on reducing non-deductible debt

Investment Loan (Equity Portion)

Options include:

-

Interest-Only (common for cash flow)

-

Principal & Interest

-

Split between both

Interest-only is often used to:

-

Improve rental cash flow

-

Maximise tax deductibility

-

Preserve equity for future investments

The right structure depends on your strategy, income, and long-term plans.

Why Separating Owner-Occupied and Investment Debt Is Critical

This is one of the most important — and often overlooked — parts of using equity.

✅ Clear Tax Deductibility

Only interest related to investment borrowing is tax deductible.

Separate loans make this clean and defensible.

✅ Cleaner Accounting

Your accountant can clearly identify:

-

Investment interest

-

Owner-occupied interest

No mixing, no confusion.

✅ Better Risk Management

Different loan types = different rates, features, and strategies.

Separation allows flexibility over time.

✅ Easier Refinancing & Future Investing

Clear loan splits make future equity releases and refinances simpler.

Poor structuring early can limit options later — this is where professional advice matters.

Final Thoughts

Using owner-occupied equity to buy an investment property is one of the most effective ways to grow a property portfolio — even if your first home was purchased with a government scheme.

The keys are:

-

Understanding how much equity you have

-

Structuring loans correctly from day one

-

Separating personal and investment debt

-

Planning with future growth in mind

If you’re considering using your equity, a tailored strategy upfront can save you tens of thousands over the life of your loans.